Is the Housing Market Slowing Down?

The latest national housing data shows a noticeable shift in market momentum, and buyers are feeling it.

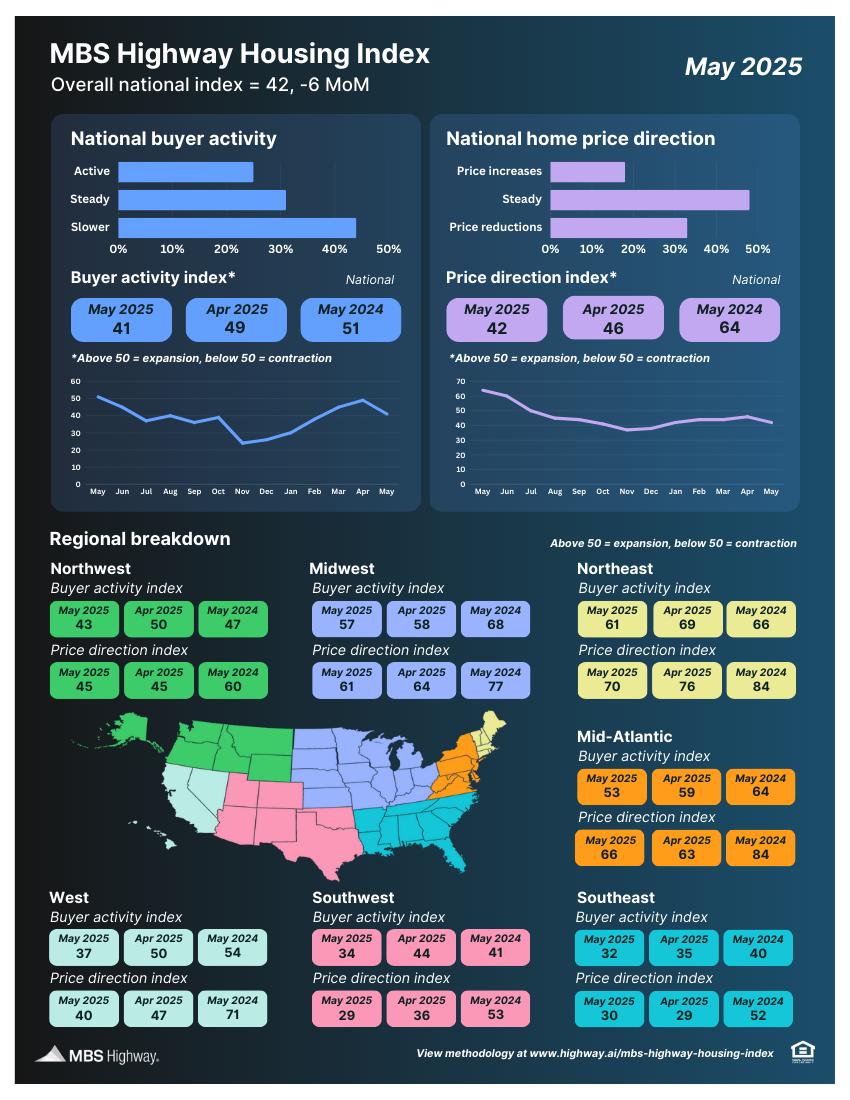

According to the May 2025 Housing Index from MBS Highway, buyer activity dipped across the board, pulling the overall index down to 42. That’s six points lower than April and marks the first monthly drop after five straight gains. If you’re wondering what that means: the index hasn’t crossed into "expansion mode" (above 50) yet this year, and concerns about the broader economy may be weighing heavier than expected.

Buyer Behavior Is Cooling—But Why?

The biggest decline came from the Buyer Activity sub-index, which fell eight points to 41. That’s a significant change from the same time last year, when activity was in positive territory at 51. Tariff uncertainty and weaker-than-expected GDP growth appear to be shaking confidence just as we head into what’s typically the busiest time of year.

Prices Are Still Rising—Just More Slowly

Even with buyers pulling back, home prices continue to grow, though at a slower pace. The Price Direction sub-index dropped to 42 nationally, down from 64 one year ago. That’s consistent with slower—but still upward—price growth.

Region by Region Snapshot

Every region saw a decrease in buyer activity. The West and Southwest took the biggest hits, with drops of 13 and 10 points, respectively. The Southeast and Southwest are now the least active markets, while the Northeast, Midwest, and Mid-Atlantic still hover just above the expansion line.

Price direction saw similar softness, with only three regions—Northeast, Mid-Atlantic, and Midwest—still showing growth above the breakeven mark. That’s a sharp contrast to last year, when all seven regions reported positive price growth.

What’s the Forecast for 2025?

MBS Highway asked professionals across the country what they expect for home prices this year. Here’s what they said:

54% believe prices will rise between 0–3%

29% expect 3–5% appreciation

12% predict a decline

5% are forecasting 5%+ growth

On average, this suggests a national price growth forecast of about 2% for 2025.

But that forecast varies by region:

Southeast: 1.1%

Southwest: 1.8%

Midwest, West, Northwest, Mid-Atlantic: 2.5%

Northeast: 3.0%

The big takeaway? While national growth may look modest, local markets still hold plenty of opportunity—especially where supply remains tight.

Thinking About Buying or Selling This Year?

The market may be cooling slightly, but strategic buyers can still find major wins, especially with guidance. Whether you're hoping to buy your first home, upgrade, or invest in a new property, the conditions are still workable… if you know how to navigate them.

Schedule a strategy call with The Mortgage Gurus and let’s walk through your options together.